Do you have a question? Want to learn more about our products and solutions, the latest career opportunities, or our events? We're here to help. Get in touch with us.

Do you have a question? Want to learn more about our products and solutions, the latest career opportunities, or our events? We're here to help. Get in touch with us.

We've received your message. One of our experts will be in touch with you soon.

As New Zealand’s largest non-bank lender, UDC Finance is committed to helping Kiwis grow by lending them funds that take them to new places.

With over 85 years of experience and 82,000 active borrowers, the business supplies vehicle and asset loans to individuals and businesses, which helps keep Aotearoa’s economy moving.

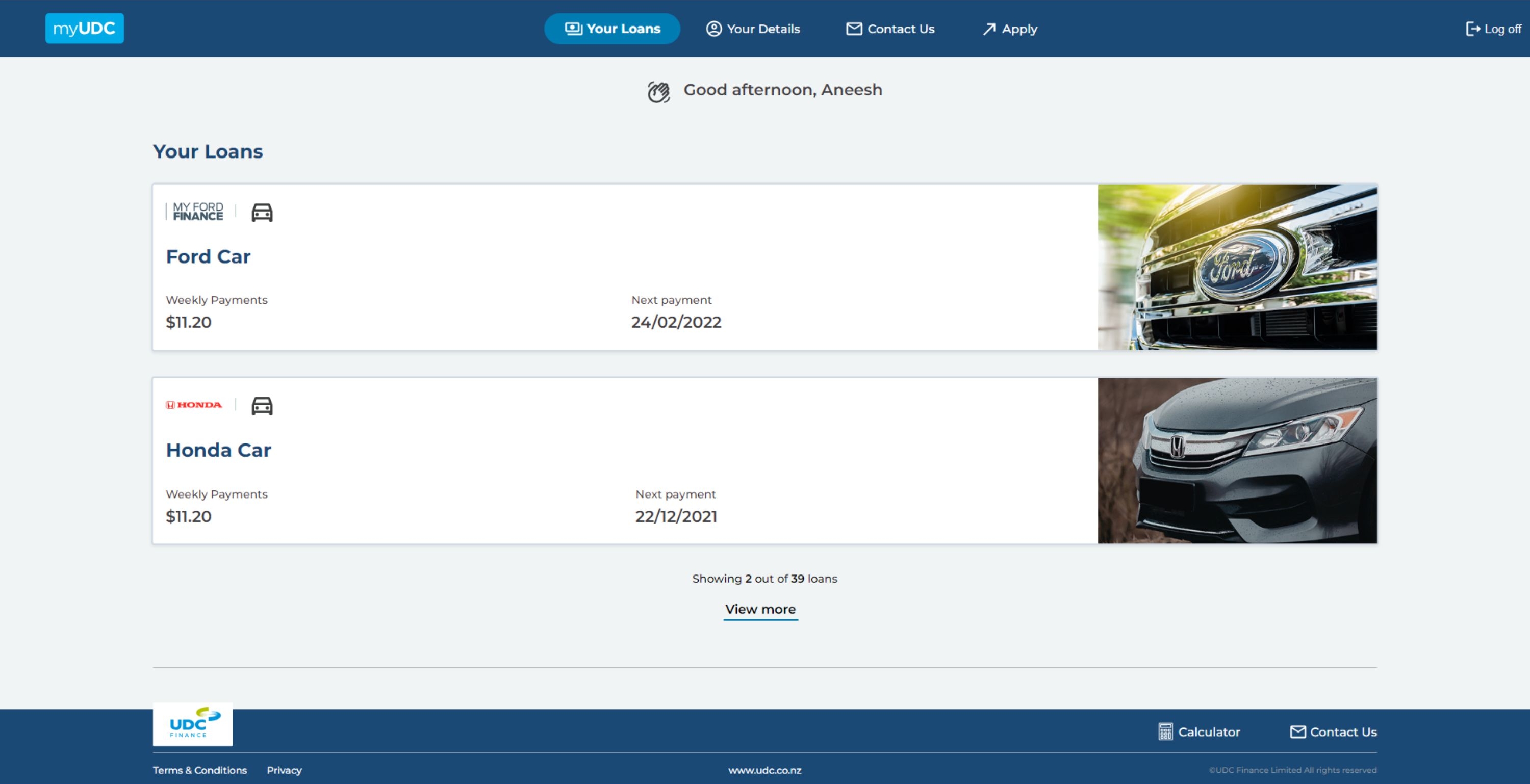

Now, a new customer portal developed with Datacom, featuring an intuitive interface and accessible tools, is helping UDC’s vehicle loan users to stay on top of their borrowing – so that their financial journeys are just as smooth as their on-road ones.

When faced with the opportunity to take on a new project with Datacom, the UDC team knew they wanted to make the most of it and do something different; but initially they didn’t know what that would look like.

The idea to develop a customer portal eventuated after UDC initiated a lightning ThinkSmash session where they ideated possible solutions with Datacom’s Transformational Engagements team to get the ball rolling.

UDC’s Chief Information Officer, Bruce Gadsby, knew there was a need for UDC to expand its customer product offerings, so when a borrower's portal was pitched after being identified as a solution that would not only address this need but also improve efficiency and growth for UDC, it was quickly recognised as a winning idea with exciting potential.

“We wanted something straightforward that would meet the needs of our customers and drive UDC toward the future, so a portal just made sense,” says Bruce.

From there, a project team was formed, composed of faces both familiar and new to UDC.

Nearly all of Datacom’s IT services are involved with UDC – a service management agreement is in place between the businesses, and over 22 teams provide UDC with ongoing support across functions. So, several Datacom team members, such as Project Manager Shane McKee, were already well acquainted with Bruce and his team.

“It was really exciting to be able to apply the knowledge I’ve acquired while working with the UDC team in a new way – their success is my success, and being a part of something that has made such an impact for them has been incredibly rewarding,” says Shane. “I think of myself as part of their team.”

Working with UDC in a new way, and with new Datacom team members, meant that the portal itself was just one of many positive outcomes for the project.

The project was executed using an Agile Scrum framework, which involves the application of Agile principles including continuous collaboration, adaptation, and improvement, across a series of Sprint phases to produce deliverables that gradually build value towards the end-product.

For the UDC team members, who had not previously taken an Agile approach with their projects, it opened their eyes to the transformative possibilities that Agile presents for the future of UDC, says Bruce.

“The project gave us the ability to take forward a new way of working that we could then see would benefit other areas of the business.”

As part of this Agile approach, the ongoing collaboration across the Agile Kickstart, Scrum, and Interface groups of the team spurred a raft of creativity and innovation. The likes of User Interface and Experience Designers, Analysts, Developers, Testers, Architects and more, combined their expertise to create a product that Bruce says, ‘goes above and beyond.’

“The project ran extremely well, and the interactive collaboration across many areas of the business and technology was a highlight. It took an already very solid relationship to new levels of engagement."

Shane says the portal was “a fun project to be a part of” that brought everyone together to create real value for UDC. “The team worked exceptionally well together, not only because they are all so talented, but also because everyone involved from both UDC and Datacom was truly engaged.”

“It was a nice-sized project with clear objectives, which meant we could maintain our focus on building and delivering the Most Valuable Product in a short timeframe while capturing UDC feedback throughout the process.”

The result of this process? For borrowers, a modern, intuitive, and accessible platform empowering them to manage their details, access their loan status and upcoming payments, and view the market value of their vehicle.

For UDC, an innovative solution that conserves resources, provides a new channel for customer interaction, and improves user experience; successfully delivered within the agreed timeline and below budget.

The project did not stop there.

“MyUDC demonstrated its own success in that we were prepared to do further iterations of it,” says Bruce, who initiated the next phase of the project using the leftover budget after seeing the impact of the first version.

This second phase involved enhancing the portal by allowing customers to apply for a new loan without having to re-enter information that UDC already has about them, making the loan application process easier. This integration further leverages UDC’s existing capability and reduces cost.

Over 25% of customers have now registered with MyUDC, with the number of users logging in each month increasing – currently over 10,000 people are doing so. Of these monthly users, 70% are viewing their loan details.

The platform is also seeing customers making use of the logged in state to quickly and easily apply for a new loan, with over 300 customers starting an application through MyUDC in the past month alone.

For UDC, the project has been an exciting foray into the future, certain to inspire more innovation as the business continues its upward trajectory.

“MyUDC has given us another face out there in the world, and it’s complimentary to the other ones we have,” says Bruce. “It represents the next phase of our evolution while staying true to our core by strengthening our position as a responsible lender supporting Kiwi futures.”