Fill in your contact details below to discuss your needs and learn more about Datapay.

Fill in your contact details below to discuss your needs and learn more about Datapay.

Thank you for submitting your interest in learning more about Datapay. A member of our Datapay sales team will be in touch to discuss your needs and provide more information about the solution.

It is crucial for your organisation to manage payroll compliance successfully to protect it from errors, enhance your reputation, and foster trust among your employees.

Datapay provides a powerful hassle-free payroll solution that adapts to the ever-changing compliance landscape. Supported by our local expert team, Datapay gives you confidence in your compliance, from accurate calculations to assisting with timely filings and tax payments.

With Datapay, you can rest assured that your payroll is aligned with the latest legislation, helping you avoid lengthy investigations and substantial penalties.

Regular, automatic software updates to reflect legislative changes for accurate calculation of entitlements and deductions.

Hassle-free PAYE returns with our Payday Filing service.

PAYE Intermediary service for timely, accurate tax payments.

Datapay helps make audits painless and manageable by providing a single source of truth for your payroll data, giving your organisation the visibility of a clear audit trail.

With an extensive set of reports, and in-application functionality, Datapay provides a clear picture of what changes were made, when, and by which user.

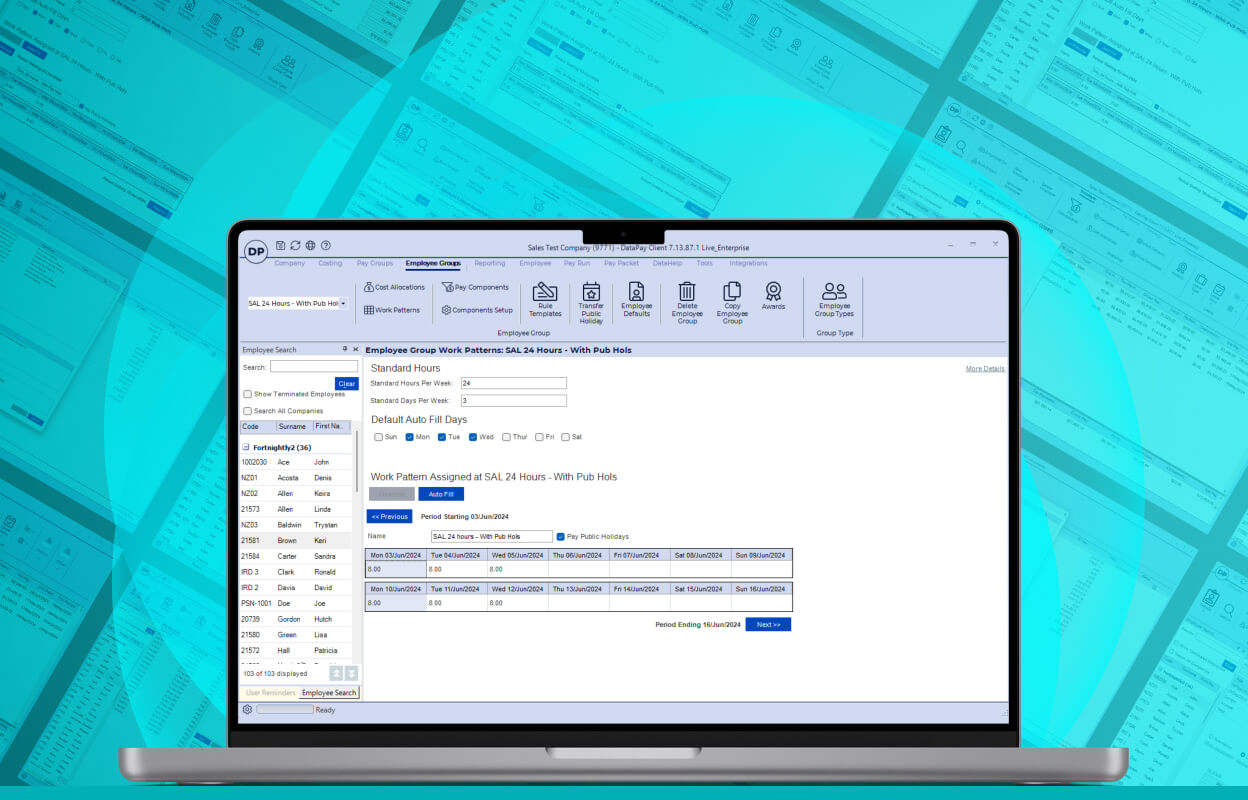

Datapay gives you a highly configurable payroll solution to help you pay your employees accurately on time, every time – helping you maintain employee satisfaction and avoiding time-consuming adjustments.

With automated payslip generation and robust self-service tools for both mobile and desktop, Datapay also gives your employees access to clear and transparent payroll information, increasing employee engagement and boosting morale.

Datapay automates complex payroll operations, delivering seamless integrations and granular configurations to meet your organisation’s needs. By doing so, Datapay optimises operational efficiency to save time, reduce costs, and minimise the risk of human error – and ultimately support better compliance.

Our experienced local teams have deep-rooted expertise in payroll and can provide guidance on best practice for payroll compliance throughout your journey with us, to support streamlined, compliant payroll operations. Datapay’s dedicated, expert team meets regularly to review changes to the payroll compliance landscape and update the Datapay system to meet the very latest regulatory requirements.

Built specifically for medium to large enterprises in New Zealand, Datapay’s powerful platform and expert support help you stay on top of your organisation’s payroll compliance.

Datapay evolves alongside changes in payroll legislation, such as the Holidays Act, PAYE tax changes and Kiwisaver rules, to support your payroll compliance.

Datapay’s automated features help you pay your employees on time, every time, avoiding financial stress and building ongoing trust.

Datapay enables employment information storage and allows date effective changes to agreements to help meet payroll compliance requirements. Datapay’s cloud-based solution gives you a real-time record of your payroll information that you can access anywhere at any time.

Datapay is ISO 27001:2022 certified to keep your employee data secure and protect it from breaches. We undertake regular penetration testing and have disaster management protocols in place so your organisation can stay compliant with data protection regulations.

Ask a question in plain English, ie. “How do bereavement-leave days accrue?” and Payroll Assistant returns the answer in seconds, linked to the exact Holidays Act or Fair Work clause.

Datapay is designed to meet the complex payroll demands of medium to large enterprises, integrating with your existing systems to drive productivity and accuracy while providing ongoing support from our team of experts.

At Datapay we understand that compliance with the Holidays Act requires an ongoing commitment to keeping up with changes to legislation and interpretation, while also monitoring for change in your workforce.

Find out what payroll risks your organisation may face with our payroll compliance risk questionnaire, including what key areas to look out for.

Your data and information are important to us. Here are some ways Datacom keeps your information assets safe:

Datacom also implements security best practices to international standards, resulting in our pay systems and data centres achieving other third-party certifications:

Maintaining a compliant payroll operation rests on three key components:

Updates in your Datapay payroll system are released every four weeks to help maintain compliance with tax legislation and calculations for entitlements and deductions. Regularly reviewing payroll reports and seeking external audits can also help ensure accuracy.

Employers should also consider investing in their payroll practitioners’ education, subscribing to updates from authorities such as Employment New Zealand, MBIE and IRD, and participating in professional associations such as NZPPA to keep up with the intricacies of changes to legislation.

As an example, read more about the compliance challenges posed by the Holidays Act.

Datapay has regular releases that will automatically include legislative updates to help maintain compliant PAYE and Kiwisaver calculations, as well as annual leave, bereavement leave, sick leave and any other leave entitlements.

Changes to tax thresholds and rates, which typically occur at the beginning of each tax year cycle, are automatically applied with no additional user intervention. Detailed release notes accompany any updates that require a change in configuration.

The Holidays Act 2003 is the legislation that governs employees’ minimum leave entitlements, payment rules and related matters in New Zealand. The Act outlines the rights and responsibilities of both employers and employees concerning public holidays, annual leave, sick leave, bereavement leave, and other forms of leave.

Application of some of the rules in the Act has proved troublesome for some employers leading to issues of non-compliance and costly remediation exercises dating back up to six years from when the issue is discovered. While reform of the legislation is currently being investigated, ensuring and maintaining compliance with the existing Act is essential.

At Datapay, we have a deep appreciation of the complexities involved in staying compliant with the Holidays Act in New Zealand. Datapay is capable of providing compliant Holidays Act calculations and is continually updated as changes to legislation occur, providing a robust platform to meet the challenges of this complex piece of legislation.

An important concept in the Holidays Act is that leave entitlements are valued at the time the leave is taken, not at the time the leave is earned.

Datapay is capable of managing leave entitlements in units of weeks for annual leave and days for other legislative leave types in line with legislative requirements. This eliminates the need to readjust entitlement balances when working patterns change while retaining the flexibility of employees requesting leave in smaller increments.

For example, consider Bob, who is contracted to work 20 hours each week. After 12 months, Bob is entitled to four weeks of annual leave. If his leave was held in hours, then his entitlement would be 80 hours.

If in his second year of employment, Bob changes to a 40-hour week, Bob’s entitlement to annual leave is still four weeks so it is important that if his leave is held in hours, that it is converted to 160 hours to reflect his new working week. No such conversion is necessary in Datapay because the underlying balance is held in weeks.

The Holidays Act requires employers to make a judgement on which leave rate calculations to use depending on the employee’s work situation. This is sometimes not clearly defined and presents a risk to employers in selecting the wrong rate to pay. To mitigate the chance of non-compliance, Datapay has the ability to support payment rate methods that pay the higher of two different leave rates to eliminate the risk of underpayment.

Employers must keep accurate records of employees' wages, time worked, and leave taken for at least seven years. This includes wage, payment and tax records, timesheets, holiday and leave records, and employment agreements. As a secure cloud-based solution, Datapay gives you an up-to-date single source of truth for your payroll data that you can access anywhere at any time, reducing the risk of losing data stored on local servers. Additionally, Datapay monitors security carefully and updates measures regularly to counter threats to data integrity.

Penalties for non-compliance can include fines, back payments of unpaid wages or entitlements, and legal action. The specific penalties depend on the severity of the non-compliance and the regulatory body involved.